Tax Depreciation Rate For Office Furniture . office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11 items of. Depreciation under the income tax act is. Hence, the balancing allowance of $500. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. to calculate depreciation for tax purposes, businesses need to: the concept of depreciation is allowed under the income tax act.

from exoipeyuh.blob.core.windows.net

Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Initial costs 11 items of. to calculate depreciation for tax purposes, businesses need to: the concept of depreciation is allowed under the income tax act. office furniture and equipment are generally depreciating assets which decline in value over time. Depreciation under the income tax act is. Hence, the balancing allowance of $500.

Depreciation Table For Commercial Buildings at Clifford Lamm blog

Tax Depreciation Rate For Office Furniture the concept of depreciation is allowed under the income tax act. Hence, the balancing allowance of $500. Initial costs 11 items of. Depreciation under the income tax act is. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. the concept of depreciation is allowed under the income tax act. office furniture and equipment are generally depreciating assets which decline in value over time. to calculate depreciation for tax purposes, businesses need to:

From www.teachoo.com

Depreciation as per Tax Assignment Depreciation Chart Tax Depreciation Rate For Office Furniture Initial costs 11 items of. the concept of depreciation is allowed under the income tax act. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Depreciation under the income tax act is. office furniture and equipment are generally depreciating assets which decline in value over time. Hence, the balancing allowance of $500. to. Tax Depreciation Rate For Office Furniture.

From exozemyaq.blob.core.windows.net

Depreciation Rate For Furniture In Kenya at Angela Fagan blog Tax Depreciation Rate For Office Furniture Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Depreciation under the income tax act is. the concept of depreciation is allowed under the income tax act. to calculate depreciation for tax purposes, businesses need to: office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11. Tax Depreciation Rate For Office Furniture.

From www.legalraasta.com

Depreciation Rate For Plant, Furniture, and Machinery Tax Depreciation Rate For Office Furniture Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Depreciation under the income tax act is. office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11 items of. the concept of depreciation is allowed under the income tax act. to calculate depreciation for tax purposes, businesses. Tax Depreciation Rate For Office Furniture.

From dxozkukvg.blob.core.windows.net

Medical Equipment Depreciation Rate Sars at Margaret Oliver blog Tax Depreciation Rate For Office Furniture Depreciation under the income tax act is. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Initial costs 11 items of. the concept of depreciation is allowed under the income tax act. office furniture and equipment are generally depreciating assets which decline in value over time. to calculate depreciation for tax purposes, businesses. Tax Depreciation Rate For Office Furniture.

From www.smartbusinesssolutions.com.au

Tax and Accounting Services Mornington and Frankston Tax Depreciation Tax Depreciation Rate For Office Furniture to calculate depreciation for tax purposes, businesses need to: office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11 items of. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Depreciation under the income tax act is. Hence, the balancing allowance of $500. the concept of. Tax Depreciation Rate For Office Furniture.

From www.indiafilings.com

Depreciation Rate for Furniture, Plant & Machinery IndiaFilings Tax Depreciation Rate For Office Furniture Hence, the balancing allowance of $500. office furniture and equipment are generally depreciating assets which decline in value over time. the concept of depreciation is allowed under the income tax act. Depreciation under the income tax act is. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. to calculate depreciation for tax purposes,. Tax Depreciation Rate For Office Furniture.

From exodfsivt.blob.core.windows.net

Depreciation On Furniture And Fixtures Rate at Lawrence Manzi blog Tax Depreciation Rate For Office Furniture to calculate depreciation for tax purposes, businesses need to: Depreciation under the income tax act is. Hence, the balancing allowance of $500. office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11 items of. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. the concept of. Tax Depreciation Rate For Office Furniture.

From www.taxmani.in

Depreciation As Per Companies Act Everything You Need to Know! Tax Depreciation Rate For Office Furniture Depreciation under the income tax act is. to calculate depreciation for tax purposes, businesses need to: office furniture and equipment are generally depreciating assets which decline in value over time. the concept of depreciation is allowed under the income tax act. Initial costs 11 items of. Hence, the balancing allowance of $500. Tax depreciation is allowable at. Tax Depreciation Rate For Office Furniture.

From standorsit.com

Do You Know Your Office Furniture Depreciation Rate? Tax Depreciation Rate For Office Furniture Initial costs 11 items of. Depreciation under the income tax act is. the concept of depreciation is allowed under the income tax act. to calculate depreciation for tax purposes, businesses need to: Hence, the balancing allowance of $500. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. office furniture and equipment are generally. Tax Depreciation Rate For Office Furniture.

From dxoaerbpc.blob.core.windows.net

Standard Depreciation Rate For Office Equipment at Peggy Nisbet blog Tax Depreciation Rate For Office Furniture Initial costs 11 items of. Hence, the balancing allowance of $500. Depreciation under the income tax act is. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. office furniture and equipment are generally depreciating assets which decline in value over time. to calculate depreciation for tax purposes, businesses need to: the concept of. Tax Depreciation Rate For Office Furniture.

From exoipeyuh.blob.core.windows.net

Depreciation Table For Commercial Buildings at Clifford Lamm blog Tax Depreciation Rate For Office Furniture Depreciation under the income tax act is. the concept of depreciation is allowed under the income tax act. to calculate depreciation for tax purposes, businesses need to: office furniture and equipment are generally depreciating assets which decline in value over time. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Hence, the balancing. Tax Depreciation Rate For Office Furniture.

From bceweb.org

Depreciation Rate Chart A Visual Reference of Charts Chart Master Tax Depreciation Rate For Office Furniture the concept of depreciation is allowed under the income tax act. office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11 items of. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Hence, the balancing allowance of $500. Depreciation under the income tax act is. to. Tax Depreciation Rate For Office Furniture.

From moneymag.com.au

The real impact of the property depreciation changes Money magazine Tax Depreciation Rate For Office Furniture Depreciation under the income tax act is. Hence, the balancing allowance of $500. the concept of depreciation is allowed under the income tax act. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Initial costs 11 items of. office furniture and equipment are generally depreciating assets which decline in value over time. to. Tax Depreciation Rate For Office Furniture.

From dxoaerbpc.blob.core.windows.net

Standard Depreciation Rate For Office Equipment at Peggy Nisbet blog Tax Depreciation Rate For Office Furniture to calculate depreciation for tax purposes, businesses need to: Depreciation under the income tax act is. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Hence, the balancing allowance of $500. Initial costs 11 items of. office furniture and equipment are generally depreciating assets which decline in value over time. the concept of. Tax Depreciation Rate For Office Furniture.

From www.researchgate.net

Depreciation rates used for each type of capital and industry Tax Depreciation Rate For Office Furniture Tax depreciation is allowable at specified rates on buildings used in qualifying industry. the concept of depreciation is allowed under the income tax act. Hence, the balancing allowance of $500. to calculate depreciation for tax purposes, businesses need to: office furniture and equipment are generally depreciating assets which decline in value over time. Initial costs 11 items. Tax Depreciation Rate For Office Furniture.

From dxohtchnc.blob.core.windows.net

Depreciation For Office In Home at Nicole Alleyne blog Tax Depreciation Rate For Office Furniture Initial costs 11 items of. office furniture and equipment are generally depreciating assets which decline in value over time. Hence, the balancing allowance of $500. Depreciation under the income tax act is. to calculate depreciation for tax purposes, businesses need to: the concept of depreciation is allowed under the income tax act. Tax depreciation is allowable at. Tax Depreciation Rate For Office Furniture.

From fitsmallbusiness.com

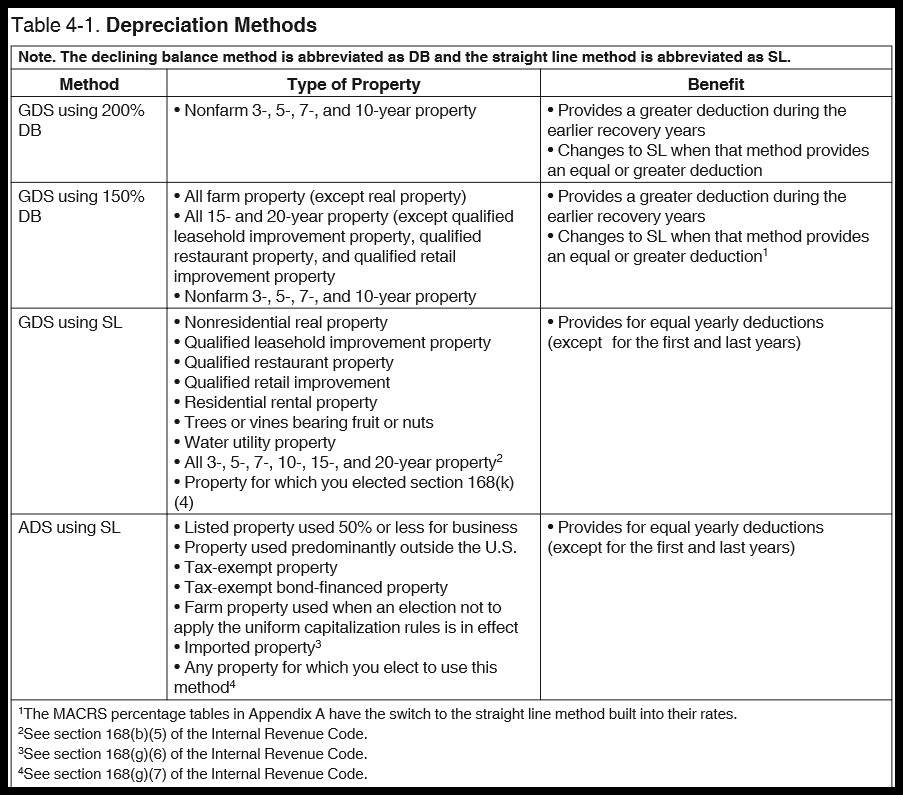

MACRS Depreciation Tables & How to Calculate 2017 Tax Depreciation Rate For Office Furniture Depreciation under the income tax act is. office furniture and equipment are generally depreciating assets which decline in value over time. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Hence, the balancing allowance of $500. the concept of depreciation is allowed under the income tax act. to calculate depreciation for tax purposes,. Tax Depreciation Rate For Office Furniture.

From www.teachoo.com

Depreciation as per Tax Assignment Depreciation Chart Tax Depreciation Rate For Office Furniture Hence, the balancing allowance of $500. office furniture and equipment are generally depreciating assets which decline in value over time. the concept of depreciation is allowed under the income tax act. Tax depreciation is allowable at specified rates on buildings used in qualifying industry. Initial costs 11 items of. to calculate depreciation for tax purposes, businesses need. Tax Depreciation Rate For Office Furniture.